What Is a Purchase Order and How to Create One

A purchase order (PO) is an essential element of long-term business operations, especially for B2B enterprises. To retain customers who frequently place large orders, store owners must be flexible in payment methods, as the value of these orders can be substantial.

Unlike retail buyers, wholesale purchasers often need to manage their cash flow to cover various expenses or investments, meaning they may not always be able to pay the full amount upfront. This is why purchase orders have become increasingly common and widely used. So, what exactly is a purchase order, and how do you create one? All of these questions will be answered in this article.

What Is a Purchase Order?

A purchase order, abbreviated as PO, is an official document between a seller and a buyer. It helps the buyer place an order without immediate payment. At the same time, from the seller’s perspective, it is a way to offer the buyer credit without risk, as the buyer is obligated to pay once products or services are delivered.

Purchase orders include the details of a variety of requirements, the type of product, quantity, price, and timeline of delivery. Each purchase order has a unique number, which helps both buyers and sellers track delivery and payment throughout the system, as well as the detailed information. The more specific information you include, the more effective your PO is.

Advantages Of Purchase Orders

This post has explored the details of purchase orders, but here’s a quick summary of how they can benefit your business:

- Buy Now, Pay Later: Purchase orders allow you to place orders for goods and pay for them during or after delivery, offering flexibility in payment terms.

- Time-Saving: Digital POs and automated systems streamline the process, making it faster and more efficient for both buyers and sellers.

- Legal Assurance: Purchase orders act as a binding document, protecting both parties by clearly outlining details like quantity, pricing, and delivery date, which can be referenced in case of disputes.

- Budget Management: With PO software, businesses can automate workflows, track expenses, and manage budgets in real-time, ensuring better financial control and improved procurement management.

By incorporating purchase orders into your workflow, you can simplify procurement, enhance transparency, and maintain better control over your operations.

Purchase Order vs. Invoice

People usually think purchase orders and invoices are the same, but they’re not. A purchase order (PO) is created by the buyer to request goods from the supplier, while an invoice is issued by the supplier to indicate the amount the buyer owes for those goods. Essentially, the PO serves as a purchase agreement, whereas the invoice acts as a payment request confirming the sale.

| Purchase Order | Invoice |

|---|---|

| - Created by the buyer - Created before purchase - Lays out goods needed - Includes proposed payment details |

- Created by the seller - Created after purchase - Confirms goods delivered - Requires payment on a specific date |

How Do Purchase Orders Work?

Now that you understand the definition of a purchase order, I will explain how it is used in actual accounting practices.

Before creating and submitting a purchase order, the employee sends an internal document to the relevant department to get approval for the order. Once it is approved, the order is finalized and sent to the vendor as a purchase order.

Then, the PO will be processed with the following steps:

Step 1: Buyer Creates a Purchase Order (PO)

Once the purchase requisition is approved, the buyer prepares a purchase order, including all the necessary details such as product name, quantity, price per unit, total cost, and expected delivery date. For instance, if you need to order boxes for shipping products, you’ll calculate how many are needed and when they should arrive. A unique PO number is then assigned to the order. Some businesses have a formal system for creating POs, while others use it more like a contract.

After drafting the PO, the buyer sends it to the seller for approval. It’s important to mention a deadline for the seller’s response to ensure the process stays on track. This allows time for adjustments or sourcing alternatives if needed.

Step 2: Seller Reviews and Approves the PO

The seller reviews the purchase order to confirm they can meet the buyer’s requirements. If they agree, they approve the PO, making it a legally binding agreement for both parties. If any details are missing or need changes, the seller can request modifications. They also have the option to cancel the order if it doesn’t align with their policies.

Step 3: Seller Issues an Invoice

After approving the PO, the seller generates an invoice that includes a payment breakdown, terms, and a summary of the products or services provided. Depending on the agreement, payment might be required before, during, or after delivery. For example, if the seller ships boxes, the invoice will outline the cost and specify the payment terms, such as payment due within 30 days.

Step 4: Purchase Order Matching

The buyer compares the details in the invoice with the purchase order to ensure they match. This step, called purchase order matching, verifies that the products or services received align with what was ordered.

Step 5: Invoice Approval

Once the buyer confirms the invoice matches the purchase order, it is sent for approval. This final step ensures the payment process proceeds smoothly and completes the transaction.

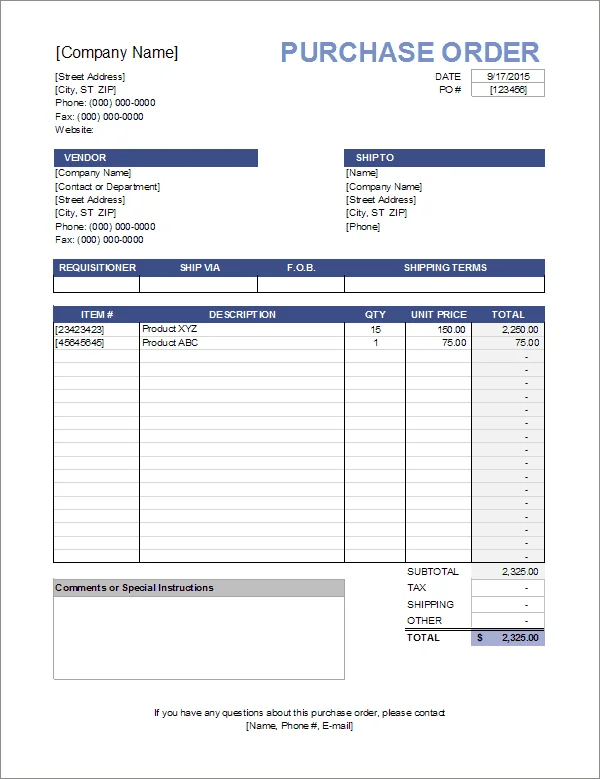

Purchase Order Format: Key Parts to Include

Ready to create your own purchase order? Here’s what you need to include:

- 1. Header: Add your company information, such as the company name, business address, purchase order date, and a unique purchase order number.

- 2. Vendor Information: Include the seller’s details: company name, address, and the specific contact person to receive the order.

- 3. Ship To: Specify the delivery details, such as the shipping address, shipping method, shipping terms, and expected delivery date.

-

4. Order Details: Provide itemized information for each product, including:

- Product code or SKU

- Item name or description

- Quantity requested

- Price per unit

- Delivery date for each product

- 5. Summary: Conclude with a summary that includes the subtotal, any discounts, applicable taxes, shipping charges, and the grand total.

Feel free to search “Purchase Order Templates” on Google, and there are tons of ready-made free templates waiting for you to download.

Types of Purchase Orders

You might think, “Once you’ve seen one purchase order, you’ve seen them all,” but that’s not true. There are five distinct types of purchase orders, each varying based on the level of detail included.

1. Standard Purchase Orders

It’s the most common type, used when the buyer knows all the details of the purchase, such as the items or services, quantity, delivery schedule, and payment terms.

Standard purchase orders include:

- Delivery date

- Item list and quantity

- Terms and conditions

Best For: One-time purchases or situations where no long-term contract is needed.

Example: A gym orders equipment, specifying the list of items, quantities, and prices.

2. Planned Purchase Orders (PPOs)

These are created in advance to estimate future needs. While details like items, price, and terms are fixed, quantities and delivery dates are tentative.

Planned purchase orders include:

- Item list

- Price

- Terms and conditions

- Tentative delivery details (date & location)

Best For: Long-term contracts or when deliveries are made in parts. PPOs allow for flexible planning and cost management, as payment is made upon delivery.

Example: A construction company sends a PPO to a supplier for materials with tentative delivery dates, adjusting the same PO for each delivery as needed.

3. Blanket Purchase Orders (BPOs)

Also known as standing orders, BPOs are for ongoing relationships with vendors. These orders specify items and pricing but are less precise about quantities and delivery dates.

Blanket purchase orders include:

- Item list

- Pricing

- Terms and conditions

- Discounts (if applicable)

Best For: Regular purchases from the same vendor, helping to simplify procurement and reduce administrative costs.

Example: A restaurant sets up a BPO with a supplier for regular deliveries of ingredients over a year, updating the order as needed.

4. Contract Purchase Orders (CPOs)

These are legally binding contracts between the buyer and seller, outlining all agreed-upon terms and conditions for future purchases.

Contract purchase orders include:

- Negotiated terms and conditions

- Details of the agreement

Best For: Establishing long-term vendor relationships with clear terms and legal protections.

Example: A business signs a contract with a vendor, and all future POs reference this agreement.

5. Digital Purchase Orders

Digital POs streamline the procurement process, making it faster and more efficient. Tools like Microsoft Excel and Open Office offer templates for creating POs.

- Digital purchase orders include: All the information of a PO (you can check the example format we mentioned in the previous part)

- Best For: Businesses seeking a convenient, editable format for purchase orders.

- Example: Using a digital template, a company creates and shares POs electronically with vendors for a smoother workflow.

Each type of purchase order serves a unique purpose, allowing businesses to tailor their procurement processes to fit their needs. Procurement and supply chain management can greatly benefit from the use of digital POs, as it enhances efficiency and communication between suppliers and businesses.

Conclusion

In short, purchase orders can streamline the procurement process and strengthen relationships between buyers and suppliers. They minimize miscommunications by clearly outlining the details of a transaction, such as items, quantities, prices, and delivery terms. Creating a purchase order doesn’t have to be complicated. With the right template, all beginners can do it.

![Top 20+ Must-have Shopify Apps for 2025 [Free & Paid] - Mageplaza](https://cdn2.mageplaza.com/media/blog/must-have-shopify-apps/top-must-have-shopify-apps.png)

![[2025 Updates] Top 10+ Upsell Apps for Shopify - Mageplaza](https://cdn2.mageplaza.com/media/blog/best-upsell-shopify-app/cover.png)