Top 13 Ecommerce Bank Accounts Tailored for B2B Businesses

Summer Nguyen | 03-17-2025

Every business, regardless of its scale, must have a bank to efficiently handle its finances. Whether you’re managing a startup or operating a multimillion-dollar ecommerce enterprise, the selection of the right ecommerce business bank account is of utmost importance.

You require a bank that not only simplifies your financial transactions but also provides tools that can contribute to the growth of your business. Nonetheless, in a market inundated with numerous business banking options, determining the most suitable bank for your specific needs can be quite challenging.

To address this challenge, we have compiled a list of the top ecommerce business bank accounts. Within this resource, we will delve into their range of services, fee structures, security protocols, and other relevant aspects to empower you in making an educated decision. Additionally, you will gain insights into the key factors to consider when selecting the optimal business checking account for your ecommerce venture.

Table of Contents

- Are There Banks Specifically for Ecommerce Businesses?

- Does Your ecommerce Business Need a Bank?

- Things to Consider When Choosing the Best Bank for ecommerce Businesses

- Best options for an ecommerce business bank account

- Conclusion

Are There Banks Specifically for Ecommerce Businesses?

While there are no banks exclusively tailored for ecommerce enterprises, certain financial institutions specialize in addressing the distinct requirements of these businesses.

These banks comprehend the specific challenges faced by ecommerce companies, including the necessity to handle a substantial transaction volume, efficiently manage cash flow, and ensure secure payment processing solutions.

Several traditional banks and fintech firms provide financial solutions specifically designed for ecommerce. Nevertheless, conducting thorough research and comparisons is vital to identify the most suitable ecommerce business bank account to stand out in nowadays digital space.

Does Your ecommerce Business Need a Bank?{#does-your-ecommerce-business-need-a-bank}

Your ecommerce business should definitely have a dedicated bank account. Selecting the right bank is essential for effectively managing your finances and ensuring a secure payment gateway.

A bank offers a secure and efficient means to oversee various financial aspects of your business, such as monitoring cash flow, settling payments with suppliers, and handling payroll. Moreover, having a dedicated ecommerce business bank account allows you to maintain a clear separation between your personal and business finances, a crucial factor for proper accounting and tax compliance.

Things to Consider When Choosing the Best Bank for ecommerce Businesses

With a multitude of banks vying for attention in the market, the process of selecting the optimal bank for your ecommerce enterprise can become overwhelming. Several key considerations should guide your choice when seeking the best bank for your business.

Your Business Needs

First and foremost, take into account the specific needs of your business. Understanding these needs is pivotal in making the right bank selection. Startups, for instance, often prioritize cost efficiency, making free business checking accounts an attractive option. Conversely, established companies may opt for major banks to uphold their reputation. Recognize that not all banks are created equal, and keeping your unique requirements in focus will lead you to a bank that can cater to your diverse needs.

Fees and Pricing

Fees and pricing constitute another crucial factor. Most ecommerce business bank accounts entail monthly maintenance fees, ATM charges, non-sufficient fund penalties, and miscellaneous fees. However, some banks may exempt you from these charges if you meet certain criteria, like maintaining a specified minimum balance or conducting a set number of monthly deposits. If you aim to minimize your business banking expenses, online-only banks, which typically do not impose monthly fees, are worth considering. It’s imperative to scrutinize the fine print of a bank’s fee structure before committing, and if uncertain, request a comprehensive fee schedule prior to opening an ecommerce business bank account.

Convenience and Ease-of-use

Convenience and ease-of-use play a pivotal role in determining the best bank for ecommerce businesses. Does the bank offer online banking or a mobile app? Seek feedback from previous customers to gauge the user experience of the bank’s mobile app. Ensuring that the bank you choose aligns with your technological preferences is crucial.

Transaction Speeds and Limits

Transaction speeds and limits are often overlooked but can significantly impact your business operations. Many banks impose transaction limits on business checking accounts, with additional fees incurred for exceeding these limits. Consider the speed and limits of fund transfers based on your business transaction needs, as you wouldn’t want operational disruptions due to hitting daily transaction limits. If your business conducts a high volume of transactions, seek a bank that permits unlimited transactions to avoid fees.

Global Accessibility

Global accessibility is a critical consideration, particularly if you require the flexibility of managing your finances from anywhere. Confirm that the bank offers online and mobile banking for convenient access. Round-the-clock access to your account empowers you to monitor your business finances and readily access funds, contributing to seamless day-to-day business operations.

Payment Integrations

Payment integrations are paramount for ecommerce businesses. Beyond a standard ecommerce business bank account, you need a bank that can seamlessly integrate with your other business software systems, such as accounting software like QuickBooks, Wave, or Expensify. Before finalizing your choice, ascertain whether your existing business software can be synchronized with the bank’s systems, as the ability to integrate multiple software and tools can streamline your business finances.

Access to Business and Reporting Tools

Access to business and reporting tools can further simplify business operations. Some business banks offer features like automated profit and loss statements and income and expense reports, which can be invaluable for efficient financial management. Prioritize ecommerce business bank accounts that provide such tools, as they can significantly enhance your ability to run your ecommerce business effectively.

Best options for an ecommerce business bank account

1. PayPal

PayPal has established itself as a trusted and widely favored choice in the realm of digital banking, renowned for its user-friendly interface that streamlines global payments. It has earned its reputation as a versatile and comprehensive solution for managing your eCommerce finances, offering functionalities such as convenient invoicing, frictionless checkout options for online stores, and the availability of a business debit card.

PayPal Business caters to a broad spectrum of businesses. It offers an ecommerce business bank account plan tailored for small-to-medium enterprises, furnishing a range of features encompassing invoicing, customer support, and more. Additionally, there is an Enterprise plan designed to meet the needs of larger organizations with substantial transaction volumes, granting access to bespoke solutions, advanced reporting capabilities, and dedicated support to effectively manage their extensive eCommerce requirements.

Similar to Wise, PayPal adopts a pay-as-you-go approach. The fees levied are contingent upon the type of transaction and the geographical location. For instance, domestic transactions within the United States incur a fee of 2.9% of the transaction amount along with a fixed fee determined by the currency used. International transactions entail the domestic fee plus an additional rate of 1.50% and a fixed fee. Separate fees apply for supplementary services like chargebacks and recurring billing.

2. Payoneer

Payoneer serves as a global payment platform with the primary goal of streamlining cross-border transactions. Its comprehensive array of features, which encompasses the ability to accept payments in multiple currencies, facilitate mass payouts, integrate with various marketplaces and networks, and provide a Payoneer Mastercard, makes it an ideal choice for entrepreneurs seeking an efficient and secure ecommerce business bank account to foster the growth of their online stores.

Payoneer simplifies its service structure by offering a single plan that encompasses all of its features and services. This approach caters to businesses of diverse sizes, and notably, there is no monthly fee, ensuring a straightforward and uncomplicated billing process.

One of Payoneer’s notable advantages lies in its integration with popular marketplaces such as Fiverr and Airbnb. Fees for transactions on these platforms are determined by each individual platform, and it is advisable to consult their respective fee structures.

Within the Payoneer ecosystem, receiving payments in USD, EUR, GBP, AUD, or CAD from another Payoneer user is free of charge. However, there is a potential percentage-based fee for receiving payments from customers or marketplaces. When it comes to currency conversion, Payoneer ecommerce business bank account employs the prevailing market rate, and they levy a nominal 0.5% fee on the transferred amount.

3. Revolut

Revolut stands as a digital banking platform that caters to the specific needs of ecommerce entrepreneurs. It offers an extensive range of features geared towards simplifying financial operations for businesses. These features encompass multi-currency accounts, international money transfers, expense management, and a user-friendly mobile app. This comprehensive suite of tools empowers businesses to streamline financial processes, effectively manage cash flow, and facilitate seamless cross-border transactions, all within a single platform.

Revolut provides a selection of four distinct ecommerce business bank account plans: Free, Grow ($39.99/month), Scale ($149.99/month), and Enterprise (custom pricing). As you progress through these plans, you gain access to additional advantages, including priority customer support, reduced foreign exchange fees, multi-level approval processes, and international payroll capabilities.

Each of the four plans comes with its own set of fees and limitations. For instance, the Grow plan offers foreign exchange at the market rate, eliminating the standard 0.4% markup, for transactions up to $10,000, while the Scale plan extends this benefit to transactions up to $50,000.

4. TIAA

TIAA stands as a well-established financial services provider, primarily serving non-profit organizations, businesses, and sole proprietors. Their comprehensive array of services includes business checking and savings accounts, cash management solutions, investment opportunities, and robust financial planning and advisory services, making them an excellent choice for establishing a strong banking foundation to support eCommerce endeavors.

Rather than offering predefined plans or packages, TIAA focuses on delivering customized banking solutions that align with the unique needs of each business. Client advisors collaborate closely with businesses to identify the most suitable combination of services, ensuring a tailored and personalized approach to meet specific requirements.

The fee structure at TIAA varies based on the chosen services and financial products. Typical bank fees, such as a monthly maintenance fee, transaction charges, interest rates, and more, may apply depending on the specific services selected by the business.

5. Chase

Chase, a renowned banking institution, offers a comprehensive array of traditional financial solutions. Leveraging its well-established reputation in the banking industry, Chase delivers a wide range of features, encompassing various types of business checking accounts, convenient access to credit, merchant services, and personalized financial guidance. What sets Chase apart is its ability to combine the advantages of both traditional and online banks, boasting an extensive network of branches and ATMs alongside a user-friendly online and mobile banking platform.

Chase caters to diverse organizational needs by providing a selection of business checking accounts tailored to different businesses: Chase Business Complete Banking, designed for smaller businesses in need of essential banking services; Chase Performance Business Checking, catering to mid-sized businesses with elevated transaction limits and cash deposit requirements; and Chase Platinum Business Checking, tailored for larger businesses with high banking activity and more extensive needs.

Chase’s fee structure varies depending on the specific checking account you select. Monthly service fees range from $0 (with qualifying activities) to $95 and can often be waived. Additional fees may apply for transactions that exceed the monthly limit and for foreign exchanges, typically amounting to 2 - 5% of the purchase amount.

6. Bank of America

Bank of America, akin to Chase, is a prominent and well-established financial institution. However, how do they stack up against each other? If you’re in search of an ecommerce business bank account that comes with the backing of a renowned financial support system, Bank of America might be the right choice. The bank provides the customary features like merchant services for payment processing, cash management tools, and access to credit lines. Notably, it also offers additional features such as Zelle for business and Quickbooks integration, demonstrating a particular focus on catering to the needs of small businesses.

Bank of America presents two primary ecommerce business bank account options. The first is the Business Fundamentals Checking account, which serves as a basic checking account tailored for smaller businesses. The second is the Business Advantage Checking account, designed for growing businesses with higher transaction volumes and more advanced banking requirements.

The Business Fundamentals Checking account entails a monthly fee of $17, while the Business Advantage Checking account carries a higher monthly fee of $29.95. It’s worth noting that these fees can often be waived, depending on specific criteria. Bank of America’s fee structure varies for different services, for instance, an outbound international wire transfer may not incur a fee but may include an exchange fee, while an outbound international wire transfer sent in USD comes with a cost of $45 per transfer.

7. Bluevine

BlueVine stands out as another excellent ecommerce business bank account option. Its streamlined checking account, lending services, and bill pay functionality provide a seamless experience for running your business. BlueVine’s business account offers notable advantages, including no minimum opening deposit, monthly fees, non-sufficient fund charges, or other incidental fees.

One standout feature is the ability to add multiple accounts, enhancing budgeting capabilities and allowing for the separation of specific business finances. This feature enables you to organize your financial resources by incorporating up to five sub-accounts, each with its unique account number.

BlueVine’s offerings include:

- Unlimited free transactions.

- Streamlined bill pay functionality, designed to save you time.

- Fee-free access to MoneyPass ATMs.

BlueVine’s online banking tools are designed to streamline your business finances further. You can seamlessly integrate accounting software like QuickBooks, FreshBooks, and Wave, and sync third-party tools, including Stripe, PayPal, and Expensify.

Additionally, BlueVine offers an attractive high-interest rate of 2% APY on account balances up to and including $250,000. This rate significantly surpasses the national average. Unlike many interest-bearing accounts, there is no requirement to maintain a minimum daily or monthly balance to earn this interest.

Furthermore, BlueVine provides access to business funding through its line of credit. Whether you’re facing cash flow constraints or require quick access to capital to fuel your business operations, BlueVine’s line of credit can be a valuable resource.

8. Capital One

Capital One distinguishes itself in the banking industry with its customer-centric approach and user-friendly solutions. The bank offers a full suite of traditional features to support and nurture your business in a secure environment. This includes merchant services for effortless payment processing and intuitive online banking tools. Additionally, Capital One extends access to lending solutions, providing eCommerce businesses with the essential financial resources necessary to facilitate growth and expansion.

Variety of Plans

Capital One presents two primary ecommerce business bank account checking options, accommodating a range of business needs. The first is the Basic Checking account, which incurs a monthly fee of $15. The second is the Unlimited Checking account, with a monthly fee of $35. These fees, however, can often be waived under specific conditions.

Capital One’s fee structure aligns with the pay-as-you-use model, which is common for various banking services. For instance, wire transfer fees differ based on the chosen checking account. With the Basic Checking account, incoming domestic wires incur a fee of $15, while outgoing wires are priced at $25 each. On the other hand, if you opt for the Unlimited Checking plan, incoming wires are free, and you receive 5 free outgoing wires each month.

9. Wells Fargo

Wells Fargo boasts a strong track record of offering banking solutions tailored to businesses, including ecommerce entrepreneurs. It’s recognized as one of the top banks for ecommerce business bank accounts due to its comprehensive services, which encompass payroll solutions, an abundance of small business resources, and offerings such as payment processing and financing, among others.

Wells Fargo provides three distinct business checking account plans, catering to businesses at various stages of growth. These plans include Initiate Business Checking, Navigate Business Checking, and Optimize Business Checking, each with its own monthly fee. These accounts are particularly well-suited for businesses aiming to scale up, granting access to valuable tools and resources, including an earnings allowance and advanced digital solutions.

Each Wells Fargo account features its own fee structure, comprising fixed monthly fees that may be subject to waivers under certain conditions. Additionally, there are fees associated with specific services. For example, while the Navigate Business Checking plan includes complimentary incoming domestic and international wires, the Initiate Business Checking imposes fees of $15 for incoming domestic wires and $16 for international wires.

10. Axos

Axos, an innovative online banking institution, offers an attractive alternative for eCommerce businesses seeking modern and digital-centric solutions. Forward-thinking entrepreneurs can capitalize on an array of services, including merchant services through Celero, payroll solutions via ADP, and small business loans provided by Centerstone. Axos also extends options for savings accounts and checking accounts to further support businesses.

Axos Bank presents two primary business checking account options tailored to suit different business needs. The first is the Basic Business Checking account, designed for small to medium-sized businesses seeking minimal fees and essential banking features. The second is the Business Interest Checking account, suitable for businesses looking to earn interest on their account balances while accessing advanced banking services, including seamless integration with QuickBooks.

The fee structure at Axos Bank is designed to be competitive and transparent. The Basic Business Checking account boasts no monthly maintenance fees and does not require a minimum deposit. In contrast, the Business Interest Checking account carries a $10 monthly maintenance fee, which is subject to waiver under certain conditions. Additional services, much like other banks, incur individual charges. For instance, incoming wires are offered free of charge, while outgoing wires are priced at $35 for domestic transfers and $45 for international transfers.

11. Skrill

Skrill stands as a prominent digital wallet solution offering specialized business solutions for ecommerce enterprises to effortlessly manage online transactions. The platform seamlessly integrates into your checkout process, facilitating frictionless payments, and providing essential features such as chargeback and fraud protection. Skrill’s multi-currency account empowers swift international money transfers, and it boasts compatibility with all major shopping cart platforms, making it convenient to activate Skrill on your eCommerce platform.

Skrill operates on a flexible pay-as-you-go model, offering versatility to businesses.

Skrill’s fee structure is multifaceted, contingent upon the type of transaction and your business’s location. Receiving money into your Skrill wallet is typically free of charge. However, when uploading funds to your Skrill wallet via methods like bank transfers, credit/debit cards, or other payment avenues, varying fees may apply. Additionally, currency conversions are executed at daily changing rates, accompanied by a foreign exchange fee that can reach up to 3.99%. These fees ensure that Skrill adapts to your specific transaction needs and location.

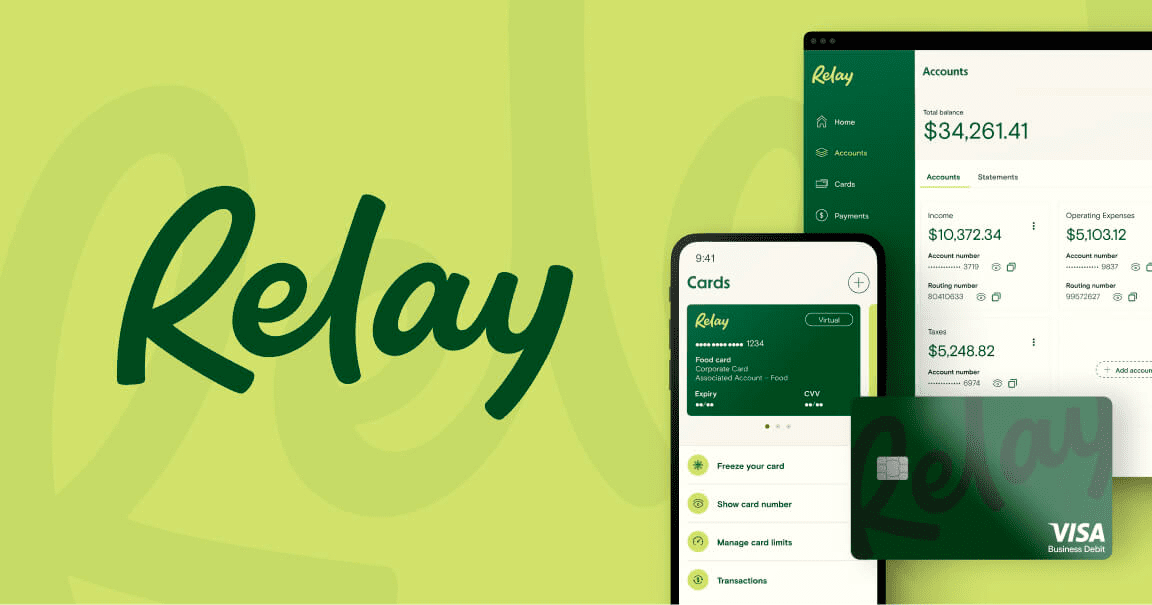

12. Relay

Relay represents a digital-first banking platform meticulously crafted to meet the demands of the B2B landscape in adopting ecommerce business bank accounts. It offers a range of features, including FDIC-insured accounts, unrestricted free transactions, seamless online bill payment, and integration capabilities with popular accounting tools. Relay’s modern and adaptable banking solution is tailored to thrive in the fast-paced eCommerce environment. Its robust API facilitates custom integrations, while automatic receipt matching simplifies bookkeeping tasks, enabling businesses to concentrate on growth and operational efficiency.

Relay provides two distinct plans to accommodate different business needs. The first is a free plan primarily targeted at new businesses, and the second is the Relay Pro plan, priced at $30 per month. The Relay Pro plan encompasses all the features of the free plan and offers additional benefits, such as free wire payments, automated imports from Quickbooks or Xero, and more.

Relay adopts a fee structure that stands out for its transparency and cost-effectiveness. Notably, Relay does not impose fees for services like overdrafts or ACH transfers. Furthermore, Relay Pro offers the advantage of free domestic and international wire transfers. In contrast, the free plan incurs a $5 fee for outgoing domestic wires and a $10 fee for outgoing international wires, which includes an exchange fee. These fees, however, remain significantly more budget-friendly compared to traditional banks.

13. Found

Found has emerged as a newcomer in the competitive landscape of the best ecommerce business bank accounts. Established in 2019, Found positions itself as an online bank catering specifically to the self-employed and freelancers.

Found’s business checking account incorporates built-in invoicing functionality, designed to streamline your workflow and save you time. The platform allows you to customize your invoices to align with your brand’s identity. For instance, you can incorporate your company logo and include personalized notes. What sets Found apart is its versatility in payment options for these invoices, including ACH, PayPal, Zelle, Venmo, and Stripe.

Moreover, Found integrates robust bookkeeping tools into its platform, simplifying your work by automatically categorizing expenses each time you use your business debit card. Additionally, you have the convenience of capturing receipts on the go, ensuring that your records remain accurate and up-to-date.

A standout feature that distinguishes Found from other banks for eCommerce businesses is its provision of automated tax planning tools. Tax planning can be a complex task for self-employed individuals and entrepreneurs alike. Found streamlines this process by offering real-time estimates of taxes as you earn and spend, and it automatically segregates funds for your tax obligations. This feature simplifies the often daunting task of managing taxes for self-employed professionals.

Conclusion

Utilizing digital banking offers a multitude of fresh possibilities for embracing diverse payment options, conducting sales transactions, and expanding your reach to a broader audience. By aligning with the appropriate digital bank for your eCommerce establishment, you can kickstart product promotion and revenue generation, all while ensuring a dependable and trustworthy banking connection remains steadfast throughout.

As we’ve explored various options for ecommerce business bank accounts in this article, from industry giants like Chase and Bank of America to innovative newcomers like Found and BlueVine, it’s clear that the ideal choice depends on your unique business needs. Whether it’s seamless payment processing, international money transfers, automated bookkeeping, or tax planning, there’s a digital bank tailored to your specific requirements.