Shopify Payments Review in 2024: What’s New and Improved?

Summer Nguyen | 03-17-2025

In 2024, Shopify Payments introduced a number of new features and enhancements designed to improve the payment processing exp for both merchants and customers. As an integrated payment solution, Shopify Payments aims to simplify transactions, increase security, and expand global reach. This review explores the latest updates, examining how these changes impact merchants and why Shopify Payments remains a competitive choice.

Shopify Payments Overview

Shopify Payments integrates seamlessly with Shopify stores, making it the default payment option for store owners. It offers many subscription options, including Starter, Retail, Basic, Shopify, and Advanced, with the Basic plan being the most popular. Additionally, Shopify Payments provides flexible integration and various point-of-sale (POS) hardware options, accommodating businesses that sell online, in-store, or both.

Pros

- Automatic setup: Shopify Payments is automatically configured with Shopify stores, allowing merchants to track orders and payments through a unified platform.

- Multi-currency support: Sell in different currencies even if they don’t match your bank’s currency. Competitive transaction fees based on the chosen plan and transaction volume.

Cons

-

Monthly subscription fees: In addition to transaction fees, Shopify Payments charges a monthly fee, unlike some competitors who only charge transaction fees. The Advanced plan costs up to $299 per month (annual plan). Additional fees, such as the Retail Business POS at $89 per month, may apply.

-

Limited availability: Exclusive to customers in 23 countries

Below are all countries where Shopify Payments is available:

| Australia | Spain | Czechia |

|---|---|---|

| Austria | Singapore | Denmark |

| Belgium | Sweden | Finland |

| Germany | Switzerland | Hong Kong SAR |

| Ireland | United Kingdom | Italy |

| Japan | United States | Netherlands |

| New Zealand | France | Portugal |

| Romania | Canada |

How Shopify Payments Works?

Shopify is a well-known Canadian company that assists businesses in creating online stores and selling products. Additionally, it is used to handle payments through Shopify Payments.

When a business starts using Shopify, it can choose to use Shopify Payments. This choice can save money on fees compared to using a third-party credit card processor, which adds an extra fee of at least 0.5% per transaction. Shopify Payments also connects directly with your store, keeping your online and in-person inventory in sync.

With Shopify Payments, you can process payments both online and in-person using point-of-sale (POS) systems. There are two versions of the POS: Lite and Pro. The hardware for the POS system includes a card reader, barcode scanner, cash drawer, printer, and interactive screen.

Read more: How to Set Up Shopify Payments to Enhance Store Performance

Key Features of Shopify Payments

Shopify Payments offers several important features for managing your online store:

- Unlimited Products: You can list as many products as you want without any limitations on the quantity of items you sell.

- Brand Management: Manage your brand’s identity by adding and updating assets like your logo and slogan directly from your Shopify account.

- Fraud Detection: Shopify Payments includes built-in fraud analysis tools that notify you of suspicious transactions. This helps you address potential fraud issues and avoid chargebacks and financial losses.

- Abandoned Cart Emails: If customers leave items in their cart without completing their purchase, Shopify Payments will automatically send them reminder emails. You can customize these emails to match your brand’s style and messaging.

- Discount Codes: Easily create and offer discount codes to your customers to encourage sales and promotions.

What Makes Shopify Payments Unique?

Shopify Payments stands out for several reasons:

-

Integrated Experience: Shopify Payments is built directly into the Shopify platform, meaning you don’t have to set up a completely separate payment gateway or merchant account. This integration simplifies the checkout process and management of transactions.

-

Streamlined Fees: It offers a transparent fee structure with no additional transaction fees on top of the standard credit card processing fees. This can help you better understand and manage your costs.

-

Global Reach: Shopify Payments supports multiple currencies and payment methods, making it easier for you to cater to a global audience.

-

Enhanced Security: It comes with built-in fraud prevention tools and PCI compliance, helping to keep transactions secure without requiring additional configurations.

-

Easy Setup: Setting up Shopify Payments is straightforward and doesn’t require any third-party integrations, reducing setup time and complexity.

-

Unified Reporting: Transactions through Shopify Payments are seamlessly integrated into Shopify’s reporting tools, providing a cohesive view of your financials and performance metrics.

Shopify Payments Pricing and Plans

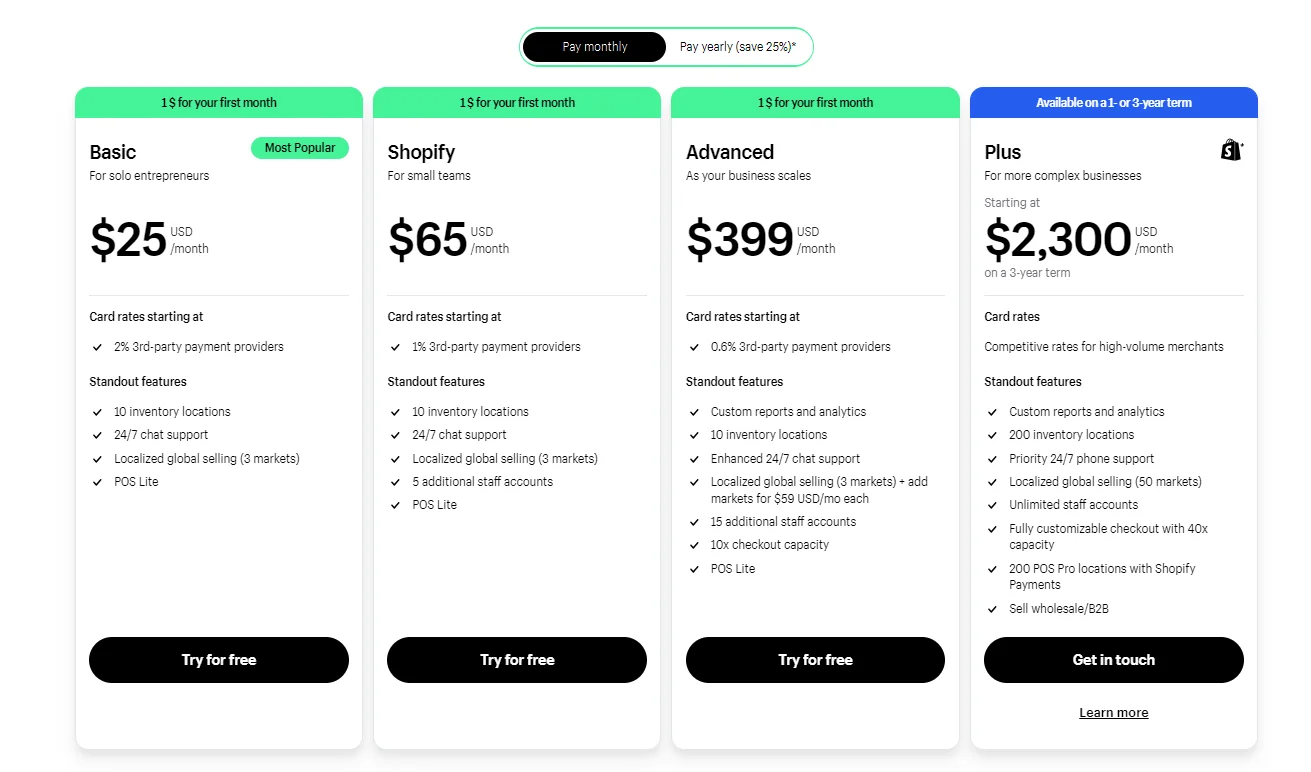

| Basic | Shopify | Advanced | Plus | |

|---|---|---|---|---|

| Pricing Pay monthly | $25 USD/mo | $65 USD/mo | $399 USD/mo | Starting at $2,300 USD/mo on a 3-year term |

| Pricing Pay yearly | $19 USD/mo* | $49 USD/mo* | $299 USD/mo* | X |

| Card rates starting at | 2% 3rd-party payment providers | 1% 3rd-party payment providers | 0.6% 3rd-party payment providers | Competitive rates for high-volume merchants |

| Additional staff accounts | X | 5 | 15 | Unlimited |

| 3rd-party calculated shipping rates | No | No | Yes | Yes |

| Transaction fees | 2% | 1% | 0.6% | 0.2% |

| More than 50 Shopify-synced orders | 1% up to $99/mo | 1% up to $99/mo | 1% up to $99/mo | 1% up to $99/mo |

| Duties and import taxes | No | No | Yes | Yes |

💡 Top tip: If you’re uncertain about which Shopify plan best fits your needs, our complete guide of Shopify Pricing Plans offers comprehensive details on each option.

Fees Associated with Shopify Payments

When choosing a payment processor, transaction fees are a key factor since you’ll pay these fees on every sale. It’s important to find the best rate for your business.

Shopify Payments has two types of fees: a monthly subscription fee and a transaction fee, both of which depend on your plan.

Starter Plan:

- Costs $5 per month

- High transaction fees of 5%

- Best for beginners

- Easy to upgrade as your business grows

- Does not include a POS system

Higher Monthly Plans:

- Lower transaction fees compared to the Starter Plan

- Shopify Plan and Advanced Plan offer better shipping discounts (up to 88%) compared to the Basic Plan (up to 77%)

Additional fees to keep in mind are:

- Chargeback Fee: Shopify Payments charges $15 for each chargeback.

- Alternative Payment Gateway Fee: If you use a different payment processor with Shopify, there are extra fees: 2% for the Basic Plan, 1% for the Shopify Plan, and 0.6% for the Advanced Plan.

- POS Pro for Retail Businesses: All plans include POS Lite. If you need advanced features like staff management and inventory tracking, you can upgrade to POS Pro for $89 per month per location. POS Pro provides unlimited staff access, customer loyalty insights, customer profiles, and retail analytics.

How to Set Up Shopify Payments?

Here’s a simple guide to setting up Shopify Payments:

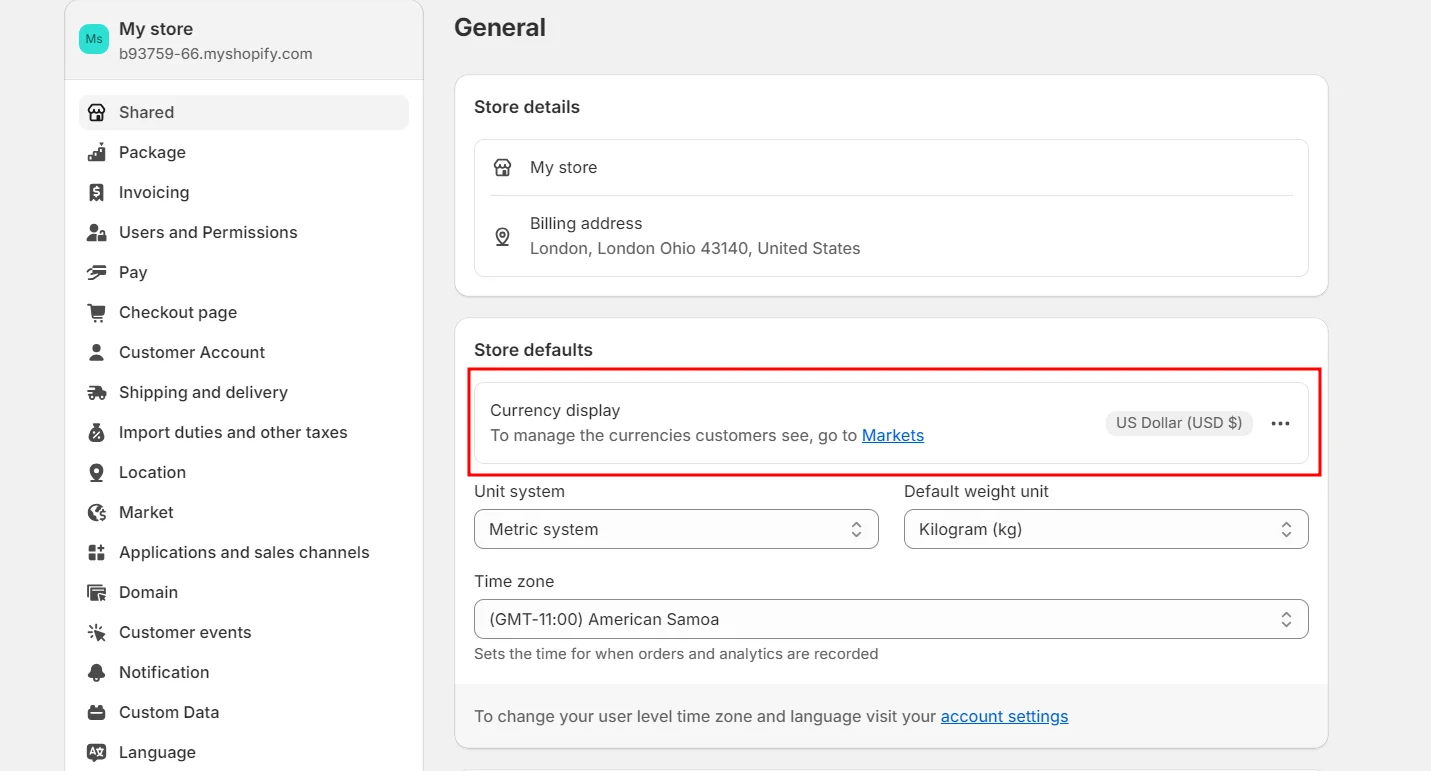

Choose Your Store Currency

This is important because it affects your product prices and sales reports. To select or change your store currency, go to Settings > General > Store currency.

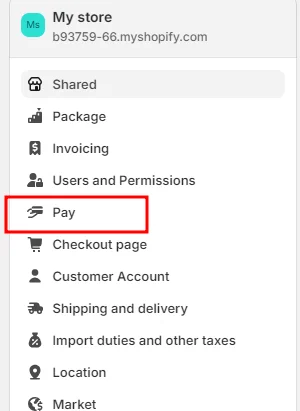

Access the Payments Section

Click on Settings on the left side of your Shopify admin, then find the “Payments” section where you can enable and manage your payment providers.

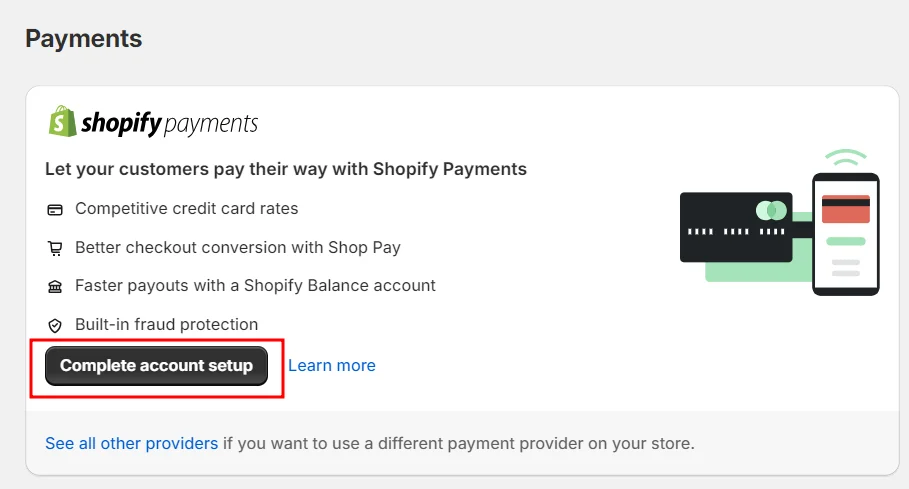

Select Shopify Payments

In the “Accept credit cards” section, Shopify Payments will be at the top of the list. It shows basic info like credit card rates and transaction fees. Click on “Complete account setup” and provide the required details.

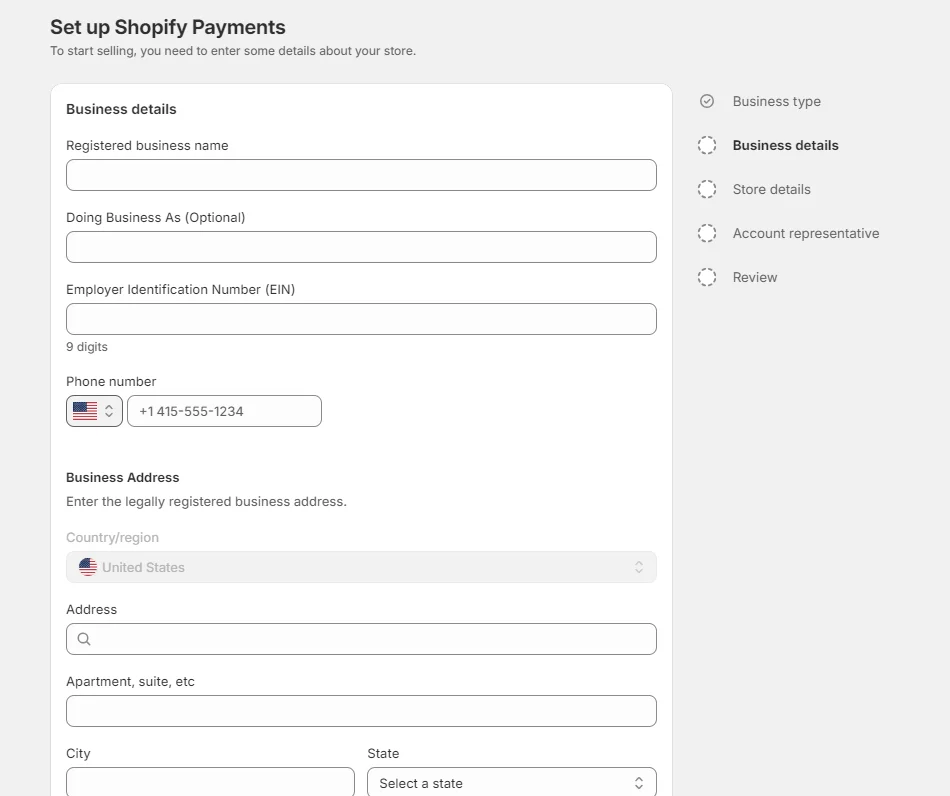

Complete Account Setup

Enter all necessary information including business, personal, product, customer billing, and banking details. Be sure to read the terms and conditions before clicking “Complete account setup.”

Test Shopify Payments

Once the setup is done, wait for Shopify to review and approve your account. To ensure everything works smoothly, place some test orders to check the payment process and fix any issues before launching your website.

Is Ease of Use for Shopify Payments?

Shopify Payments is designed to be user-friendly and straightforward:

- Simple Setup: Activating Shopify Payments is easy. You can enable it directly from the Payment Providers section in your Shopify settings.

- Integrated System: It works seamlessly with your Shopify store, so you don’t need to deal with third-party integrations or additional configurations.

- Easy Currency Management: Setting your store currency is simple & clear, and it can be done easily from your account settings.

- Clear Fee Structure: Shopify Payments provides a clear breakdown of fees, including transaction fees and credit card rates, making it easy to understand the costs.

- Streamlined Payments: Customers can pay using credit cards directly in your store, and the payment processing is handled smoothly by Shopify Payments.

Read more: Your Shopify Payments Account Is On Hold: Reasons And Solutions

Shopify Payments Security Measures

All Shopify stores meet Level 1 PCI DSS standards. This is a set of security rules for companies handling credit and debit card payments.

Shopify Payments ensures security by:

- Keeping a secure network

- Protecting cardholder information

- Managing vulnerabilities

- Using strong access controls

- Regularly monitoring and testing networks

- Following an information security policy

Customer Service and Support for Shopify Payments

Shopify Payments provides several support options:

- Live Chat: Available 24/7 for immediate help.

- Community Forum: A place to find answers and discuss general and technical questions. It has sections for discussions, groups, events, and a blog.

- Help Center: Offers tutorials and video guides on various payment processing topics, including POS, sales channels, and checkout.

Note that Shopify Payments does not provide phone support.

Important Details: The Starter plan costs just $5 per month, but its transaction fees are higher compared to many competitors. For instance, Square charges 2.9% plus 30 cents per transaction for online payments and has no monthly fee. Additionally, Shopify Payments doesn’t support offline payments, which some other payment processors do offer.

Alternatives to Shopify Payments and Comparisons

Feature |

Shopify Payments | Square | Stripe | Clover |

|---|---|---|---|---|

| Monthly Fee | Starts at $5 | $0 | $0 | $14.95 |

| Transaction Fees | 2.9% + 30 cents (for online transactions with Basic plan) | 2.6% to 3.5% + 10 cents to 30 cents | 2.7% to 2.9% + 5 cents to 30 cents (domestic) | 2.3% + 10 cents (with card) <br> 3.5% + 10 cents (without card) |

| POS Hardware Cost | Starts at $29 per month | Starts at $10 | Starts at $59 | Starts at $49 |

| Funding | Standard next business day | Standard next day | Standard two business days; Instant Payouts within 30 minutes for a 1% fee | Standard one to three business days, or instant with Clover Rapid Deposit for a 1.5% fee |

| Integrations | Software and POS integrations | Many options through Square App Marketplace, including Acuity Scheduling, QuickBooks Online, Wix, and WooCommerce | Various integration partners for billing, checkout, identity, payment links, and more | Payment processing, inventory management, and software integrations through Clover App Market |

| Contactless Payment | Yes | Yes | Yes | Yes |

| Reports and Analytics | Yes | Yes | Yes | Yes |

| Customer Support | Live chat, chatbot, FAQ, Shopify Help Center, Shopify Community | Phone or email support | Email, chat, phone (request a call with average wait time of three minutes) | Phone support, FAQ section, and small business resources |

Shopify Payments vs. Square

Shopify Payments is a great choice if you’re already using Shopify since it’s the default payment option. However, Square is more versatile and very easy to set up. While Shopify Payments has a starter plan with a 5% transaction fee, Square’s basic transaction fees are lower.

Read more: Shopify vs Squarespace: Which Platform Should You Choose?

Shopify Payments vs. Stripe

Stripe offers more flexibility and works well for businesses that don’t use Shopify. It integrates with many different platforms like Adobe Commerce (Magento), Shopware, WooCommerce, and WordPress. Stripe also makes it easy to accept international payments, which is ideal for businesses operating in multiple countries.

Read more: Shopify Payment Vs Stripe: A Feature-by-Feature Comparison

Shopify Payments vs. Clover

Both Shopify Payments and Clover have many features, but Clover is better suited for restaurants. Shopify Payments is more appropriate for online stores using Shopify and retail businesses.

FAQs

1. Is Shopify Payments a reliable payment processor?

Absolutely! Shopify Payments is a highly secure and trustworthy option for online businesses. It’s PCI compliant, ensuring the highest standards of data security. Plus, its built-in fraud analysis feature automatically flags suspicious orders, protecting your business from potential losses.

2. How does Shopify Payments prevent fraud?

Shopify Payments uses various fraud prevention measures, including automated fraud analysis, manual review, and address verification. These measures help to identify and prevent fraudulent transactions.

3. Should I choose PayPal or Shopify Payments?

The best payment processor for you depends on your specific business needs. If you operate primarily online through a Shopify store, Shopify Payments might be the more convenient option. It integrates seamlessly with your store, providing a smooth customer experience and potentially lower transaction fees. However, if you also accept payments in person or require more advanced features, PayPal might be a better fit.

Consider factors like your location, transaction volume, and desired features when making your decision.

4. What are the drawbacks of Shopify Payments?

Shopify Payments requires a monthly subscription fee in addition to transaction fees. These costs can add up to more than what you might pay with competitors like Square. However, if you’re using Shopify for your online store and choose a third-party payment processor, you’ll also incur an extra transaction fee ranging from 0.5% to 2%.

5. Can I use Shopify Payments with other payment gateways?

While Shopify Payments is a built-in solution, you can still integrate with other payment gateways if needed. However, this might require additional setup and configuration.

Conclusion

Shopify Payments in 2024 brings significant advancements that make it an even more robust and reliable payment solution for e-commerce merchants. The enhanced security features, expanded currency and country support, and seamless integration with Shopify’s platform are key improvements that can help businesses streamline their payment processes and reach a wider audience. For merchants looking to optimize their checkout experience and ensure secure transactions, Shopify Payments continues to be a top contender in the payment processing market.