How to Configure Canadian Tax in Magento 2

06-30-2016

Today, we will together learn how to configure Canadian Tax and specifically how to create GST tax rates for Canada and PST tax rates for Saskatchewan in Magento 2 settings. All instructions are given in details to make sure that the tax rules and rates are correct to apply for your Canadian Tax.

In addition to Canadian Tax, you also have the certain example about US Tax and EU Tax. Follow these links to get a deeper understanding about the tax rules and rates configuration on Magento 2 stores.

Configure Canadian Tax in Magento 2

- Step 1: Accomplish the Tax Calculation Settings

- Step 2: Configure Canadian Goods & Services Tax (GST)

- Step 3: Configure Canadian Provincial Sales Tax (PST)

- Step 4: Add a GST Tax Rule

- Step 5: Add a PST Tax Rule for Saskatchewan

- Step 6: Save and Test the Results

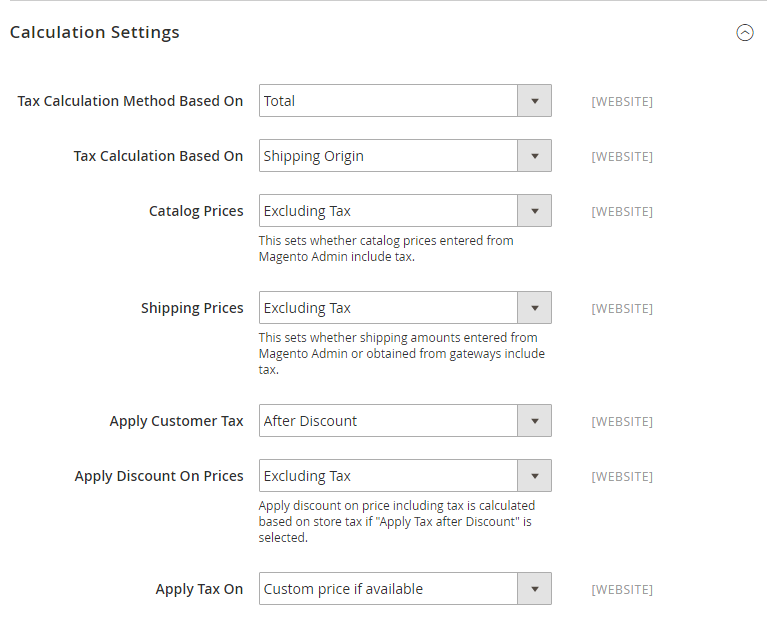

Step 1: Accomplish the Tax Calculation Settings

- On the Admin Panel,

Stores > Settings > Configuration. - On the left panel, under

Sales, selectTax. - Expand the Tax Calculation Settings section,

- In the

Tax Calculation Method Based Onfield, allow calculating the tax on “Total” value of the order. - Choose “Shipping Address” option for the

Tax Calculation Based Onfield. - “Excluding Tax” from the

Catalog PricesandShipping Priceswhen setting up US Tax. - Allow the US tax include the discount amount by choosing “After Discount” in the

Apply Customer Taxfield. - In the

Apply Tax Onfield, choose “Custom Price” (if available).

- In the

- Open the Tax Classes section, set the

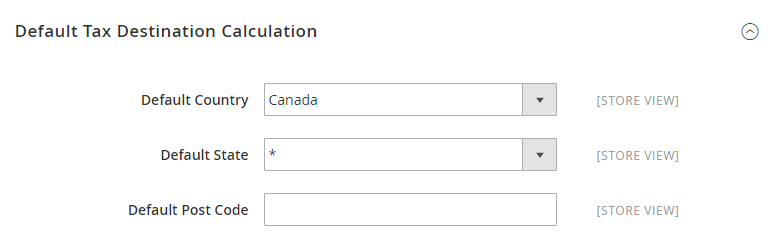

Tax Class for Shippingto “Shipping”. - Expand the Default Tax Destination Calculation section,

- Set the

Default Countryto “United States”. - Set

Default Stateto where business is located”. - Set

Default Post Codeto the number range according to the state you set.

- Set the

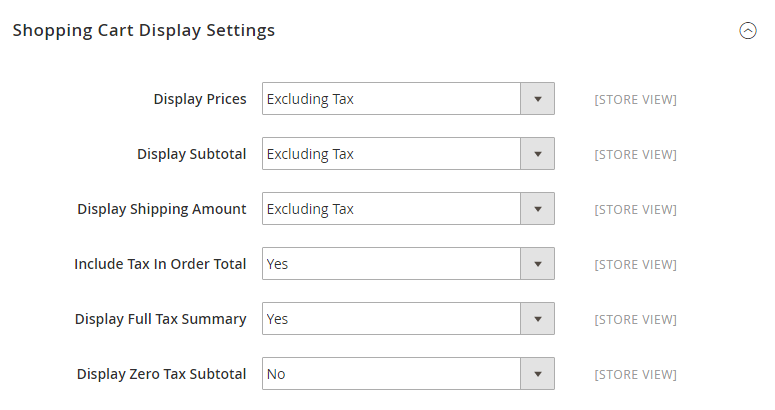

- Open the Shopping Cart Display Settings section.

- Set

Include Tax in Grand Totalto Yes. - Set

Display Full Tax Summaryto Yes. - Set

Display Zero in Tax Subtotalto Yes.

- Set

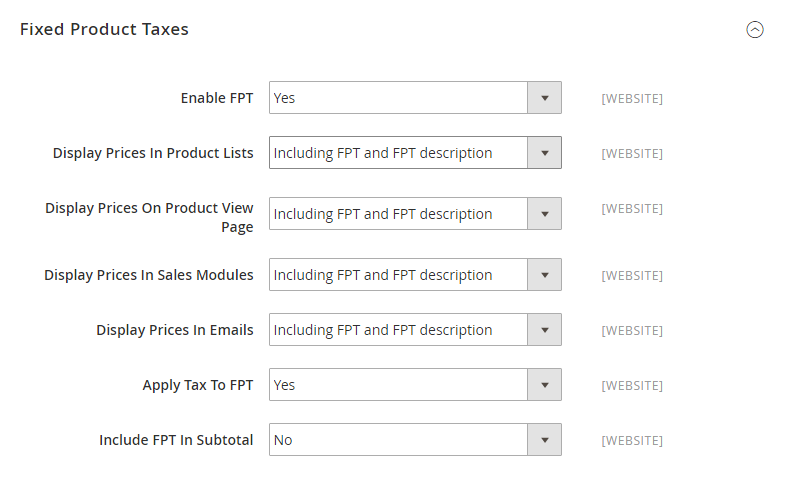

- Open the

Fixed Product Taxessection,- Apply the FPT for the Canadian Tax when you choose “Yes” in the

Enable FPTfield. - Select “Including FPT and FPT description” for all FPT Display Settings including

Product Lists,Product View Page,Sales Modules, andEmails. - Agree with

Apply Tax to FPTwhen you choose “Yes”. - Set

Include FPT In Subtotalto “No” for the Canadian Tax.

- Apply the FPT for the Canadian Tax when you choose “Yes” in the

Step 2: Config Canadian Goods & Services Tax (GST)

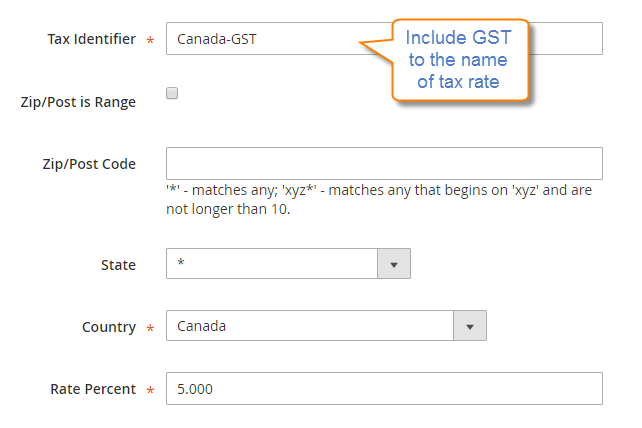

Insert the GST into the name of applicable tax rates to display the GST number on the invoices as well as other sales documents. Thus, The GST will appear as a part of the GST amount on any order summary.

- On the Admin Panel,

Stores > Taxes > Tax Zones and Rates. - CLick on Add New Tax Rate and set it as the following image:

Step 3: Config Canadian Provincial Sales Tax (PST)

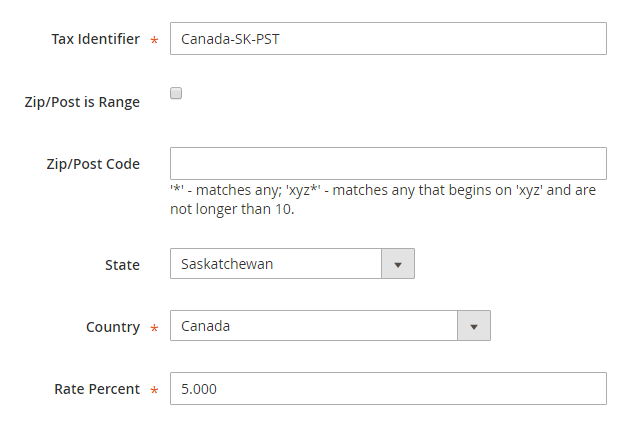

Create another tax rate for the applicable province

- Go to the Add New Tax Rate information, then set some necessary as the following:

- Enter the

Tax Identifierby Canada-SK-PST. - Choose “Canada” for the

Countryfield. - Choose “Saskatchewan” for the

Satefield.

- Enter the

Step 4: Add a GST Tax Rule

To prevent the confusion of the GST and PST tax rule when you calculate tax, it is important to set different priorities for each rule and mark the “Calculate off subtotal only” checkbox. Each tax appears as a separate line item, but the tax amounts are not compounded.

- On the Admin Panel,

Stores > Taxes > Tax Rules. -

Tap the Add New Tax Rule button, and complete the necessay information as the following example for Retail Customers.

- Set

Nameto “Retail-Canada-GST” - Set

Customer Tax Classto “Retail Customers” - Choose “Taxable Goods” in the

Product Tax Classfield. - Select the “Canada-GST” to offer the tax rate.

- Set

PriorityandSort Orderto zero. - Mark the

Calculate off subtotal onlycheckbox.

- Set

Step 5: Add a PST Tax Rule for Saskatchewan

For the PST Tax Rule, make sure that the priority is empty and the “Calculate off subtotal only” is selected. Each tax appears as a separate line item, but the tax amounts are not compounded.

-

Go to the Add New Tax Rule information page,

- Set

Nameto “Retail-Canada-GST” - Choose “Taxable Goods” in the

Product Tax Classfield. - Select the “Canada-SK-GST” to offer the tax rate.

- Set

Priorityto 1. - Mark the

Calculate off subtotal onlycheckbox. - Not give the

Sort Order.

- Set

Step 6: Save and Test the Results

- Hit the

Save Configto complete. - Access your storefront and check it by placing an order for demo.

Related Post