How to Setup Fixed Product Tax in Magento 2

06-29-2016

Setting up fixed product taxes in Magento 2 can seem daunting, but it’s a crucial step for businesses that need to comply with specific tax regulations. This guide will break down the process step-by-step, making it easy to understand and implement fixed product taxes in your Magento 2 store.

What is Fixed Product Tax?

Applying the Fixed Product Tax (FPT) is one of the tax options that is supported well by Magento 2. Unlike other taxes such as VAT or sale taxes that are calculated with a percentage of the order price, the FPT gives customers a fixed number for the tax. For instance, there are certain tax types that require fixed charges regardless of the product price, such as the WEEE tax (Waste Electrical and Electronic Equipment Directive), or commonly known as the eco-tax. Therefore, instead of configuring the tax rates and the tax rules, from Magento 2 configuration, you need to set the conditions of the product attributes. With the help of attributes, the FPT is auto-added to the payment process.

Key benefits of using Magento Fixed Product Taxes

Magento Fixed Product Taxes (FPT) offer several advantages for managing your store’s taxes:

- Simplified Tax Management: FPT uses a fixed amount instead of percentages, eliminating complex calculations and reducing errors for easier tax compliance.

- Accurate Pricing: Prevents fluctuating tax charges, ensuring customers see the exact tax amount upfront, improving trust and the shopping experience.

- Regulatory Compliance: Easily meets regional tax requirements (e.g., WEEE tax) by configuring fixed amounts per product, avoiding legal issues.

- Easy Magento Setup: Simply define conditions based on product attributes, and Magento applies the fixed tax automatically at checkout.

- Customer Trust: Transparent pricing eliminates checkout surprises, enhancing the shopping experience and encouraging repeat business.

Setup Fixed Product Tax (FPT) in Magento 2

- [Step 1: Activate Fixed Product Tax]](#step-1-activate-fixed-product-tax)

- Step 2: Add an FPT Attribute

- Step 3: Assign the FPT Attribute to an Attribute Set

- Step 4: Add FPT to a Specific Products

Step 1: Activate Fixed Product Tax

- On the Admin Panel,

Stores > Settings > Configurations. - On the left panel, under

Sales, select theTaxtab. - Open the

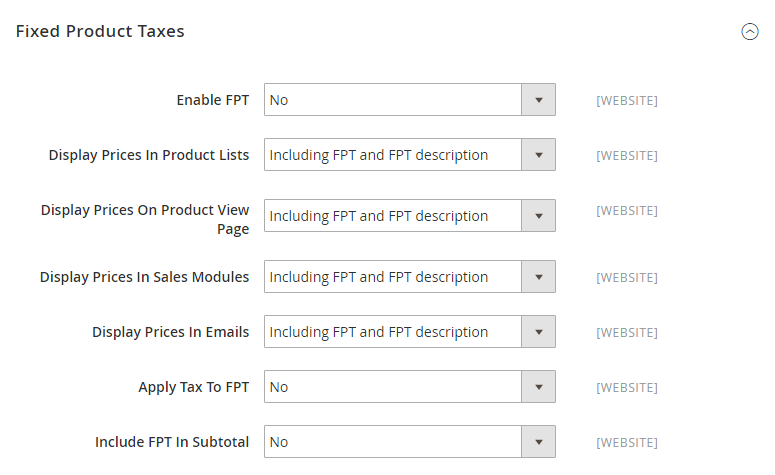

Fixed Product Taxessection,- Choose “Yes” to

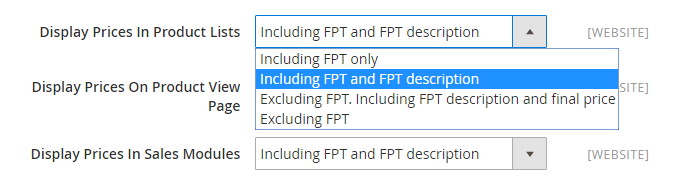

Enable FPT. - Select the FPT setting for the price display location including

Product List,Product View Page,Sales Modules, andEmails.

- Choose “Yes” to

- Set

Apply Tax to FPTto “Yes” if you need. - Set

Include FPT in Subtotalto “Yes” to add tax when calculating the subtotal for any order.

Step 2: Add an FPT Attribute

- On the Admin Panel,

Stores > Attributes > Products. - In the upper-right corner, hit the

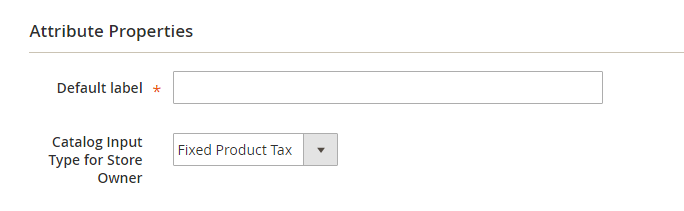

Add New Attribute, and do as the following:- Fill the

Default Labelfor the attribute. - In the

Catalog Input Type for Store Ownerfield, select Fixed Product Tax option.

- Fill the

- Open

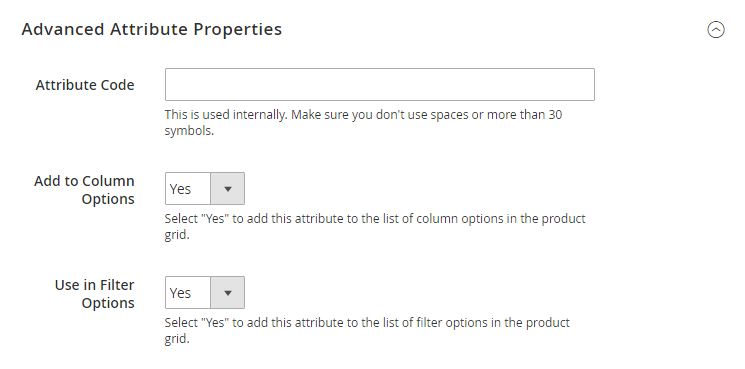

Advanced Attribute Propertiessection,- Enter less than 30 characters in lowercase without any spaces or special characters in the

Attribute Codefield. - To display the FPT field in the Inventory grid, set

Add to Column Optionsto “Yes”. - In the

Use in Filter Optionsfield, choose “Yes” to enable the product filters in the grid based on the value of the FPT field.

- Enter less than 30 characters in lowercase without any spaces or special characters in the

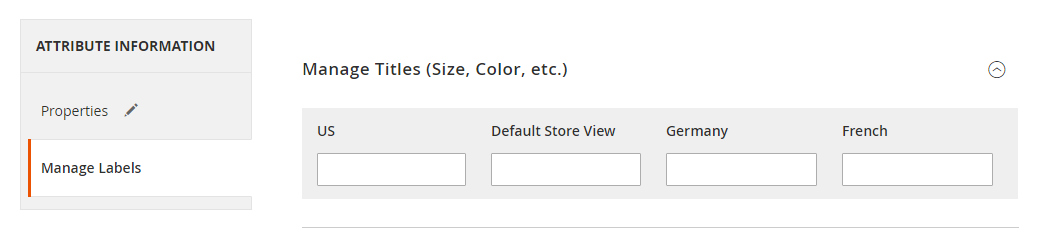

- If you want to set different labels for different store views, go to

Manage Labelstab to do that.

- Click

Save Attributeto complete, then accessCache Managementlink to flush the cache and ensure that the configurations are active.

& Maintenance Services

Make sure your store is not only in good shape but also thriving with a professional team yet at an affordable price.

Get StartedStep 3: Assign the FPT Attribute to an Attribute Set

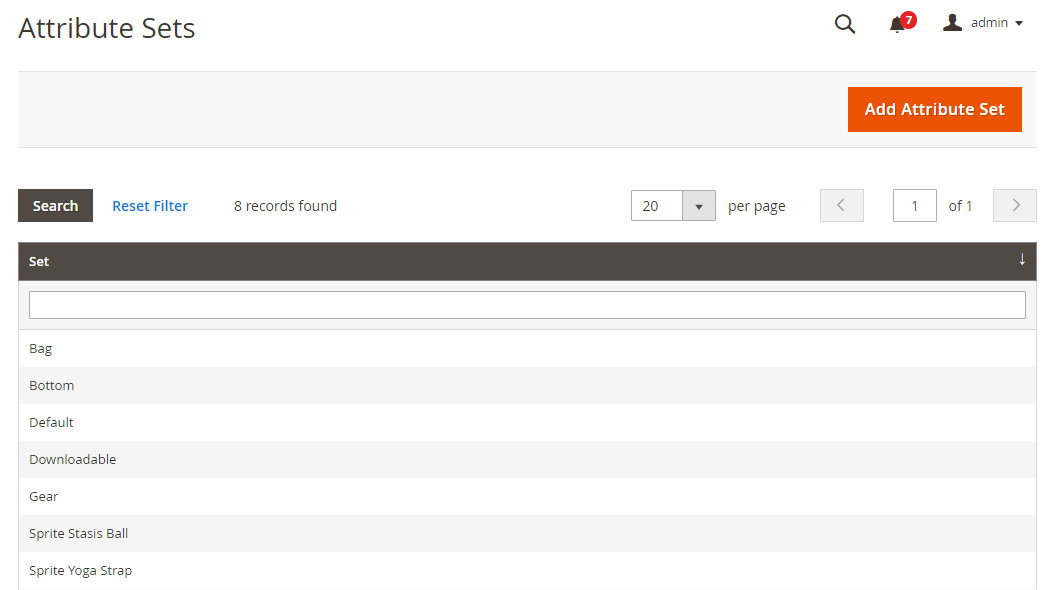

- On the Admin Panel,

Stores > Attributes > Attribute Set. - In the Attribute list, find the needed attribute and go to the edit mode.

- Choose the FPT attribute in the

Unassigned Attributeslist and drag it to theGrouplist.

Each group folder is set respectively to a section of product information. Thus, it is comfortable to place the attribute wherever you want it to appear when the product is open in the edit mode.

- Click

Saveto complete. - Repeat this step for each attribute set that needs to include fixed product tax.

Step 4: Add FPT to a Specific Products

- On the Admin Panel, go

Product > Inventory > Catalog. - Find the needed product in the list, then open the edit mode to add the FPT.

- In the FPT section of fields that you added to the attribute set, click on

Add Tax, and do the following:- If you have multiple stores, choose the

Websiteand base currency to apply. - Set the

Country/Statefor the fixed product tax. - Offer the amount of the fixed product tax.

- If you want to add more FPT, continue to use

Add Taxbutton and repeat the guide above.

- If you have multiple stores, choose the

- Click

Saveto complete

Magento Fixed Product Tax: Common Issues and Solutions

This section highlights common issues with Magento Fixed Product Taxes (FPT) and provides practical solutions to ensure accurate tax calculations and a seamless checkout experience.

| Issues | Solutions |

|---|---|

| The FPT is not being correctly applied to the designated products. | - Make sure the FPT attribute is set up correctly in the product settings - Confirm that the attribute is assigned to the correct product types - Check that the tax class settings in Magento are properly configured - Reindex and clear the cache to apply any changes - Ensure the FPT module is enabled in your Magento settings |

| The displayed Fixed Product Tax amount is incorrect. | - Verify the FPT value in the product's attributes - Ensure no conflicting tax rules interfere with FPT calculations - Check that the currency settings are correctly configured - Reindex and clear the cache to update the FPT amount - If the issue persists, test on a clean Magento installation |

| The FPT is not displayed on the checkout page. | - Make sure the FPT attribute is enabled and correctly configured. - Check the store view and website settings to confirm FPT is active. - Ensure there are no conflicting tax settings. Test the checkout process to identify any issues. |

| There are errors in the FPT calculations. | - Make sure the FPT amount is correctly entered in the product attribute - Check for overlapping tax rules that might affect FPT calculations - Verify the currency and locale settings - Reindex and clear the cache to fix any errors - Test with different products to spot any patterns |

| The Fixed Product Tax is not updating after changes are made. | - Reindex and clear the cache to apply changes - Confirm that the FPT attribute has been correctly updated - Check for system overrides that might affect FPT - Ensure all product types reflect the updated FPT settings - If issues persist, test on a clean Magento installation |

Optimal strategies for implementing fixed product taxes in different business models

1. Configure FPT for electronics

- Apply WEEE tax to eligible products

- Set a fixed tax amount for each product

- Ensure product attributes align with FPT settings

- Reindex and clear the cache after making changes

- Regularly review tax compliance requirements

- Check FPT accuracy during checkout

2. Implement FPT for eco-friendly products

- Apply eco-tax to eligible products

- Display tax details clearly on product pages

- Configure FPT to comply with legal requirements

- Reindex and clear the cache to apply updates

- Regularly review tax settings for compliance

- Inform customers about the benefits of eco-tax

3. Apply FPT to recyclable materials

- Identify products that require recycling fees

- Set fixed tax amounts in the product attributes

- Clearly display tax details on product pages

- Reindex and clear the cache to apply updates

- Keep records of FPT applications

- Ensure compliance with recycling fee regulations

4. Utilize FPT in international commerce

- Research regional tax regulations

- Configure FPT separately for each market

- Use currency conversion for accurate FPT

- Reindex and clear the cache for each market’s settings

- Update FPT regularly to account for currency changes

- Ensure compliance with local tax laws

5. Applying FPT to seasonal product

- Identify seasonal products that require special taxes

- Set fixed tax amounts for the applicable periods

- Ensure FPT is correctly applied to product attributes

- Reindex and clear the cache after making changes

- Monitor sales to verify FPT accuracy

- Adjust FPT settings after the season if needed

FAQs

1. How does Magento 2 calculate taxes?

Magento 2 applies tax rules based on your configured settings. You can choose to display prices with or without tax. By default, the system follows predefined tax settings unless customized. Proper configuration ensures accurate tax calculations.

2. Why isn’t my FPT included in the product price?

If your Fixed Product Tax (FPT) is missing from the product price, check your tax settings. Ensure the FPT attribute is correctly assigned to the product and that the option to include tax in the price is enabled. Reindex and clear the cache to apply changes.

3. Can I show product prices without tax in Magento 2?

Yes, Magento 2 allows you to show product prices without tax. Adjust the tax settings in the admin panel to exclude tax from displayed prices. This is useful if you prefer to show the base price and apply tax at checkout. Ensure your settings align with your business needs.

4. How do I fix tax configuration issues in Magento 2?

To troubleshoot tax issues, verify your tax rules and settings. Ensure default tax rates are accurate and that the FPT attribute is correctly configured. Reindex and clear the cache. Test with different products to identify patterns. Using a reliable Magento hosting service can also help prevent tax-related issues.

The bottom line

Fixed Product Tax in Magento 2 can be created with the view to setting up a fixed rate of tax based on product attributes. It enables stores to comply with tax rules, but stores should consider the FPT quoting in email, as only the total price will be displayed, and the price difference will make customers hesitate in purchase decisions.

Read the below posts if you are wondering about other tax issues.

Related Post